Our biggest event of the year is October 7—Prairie Harvest Fest!

In the ever-evolving landscape of real estate, the decision to purchase a home is a significant one. Timing plays a pivotal role in ensuring a sound investment that brings value as it appreciates over time. Historically, home ownership has always been a hedge against inflation, and offers the stability of a set monthly housing payment. Your monthly housing payment is making an investment in your own asset. Something you don’t get by renting.

Inflation impacts the cost of rents as well as interest rates on mortgages. The advantages of investing in a new home, such as stability, tax benefits, and – everyone’s favorite, building wealth over time – are hard to deny when choosing whether to rent or buy a new home.

New construction homes, often built with modern amenities and energy-efficient features, are expected to offer lasting value. These modern features save you money, lower your utility bills, and feature the best in interior home design. Resale home inventory remains low, but new home inventory is available and ready for new buyers to move in.

Another key factor in considering buying a new home construction home is that most new home communities are located in amazing up and coming areas. Painted Prairie is located in one of the fastest growing markets in the Denver Metro Area. The aerotropolis area is slated to bring thousands of new jobs, new ways to travel, and new opportunities to live, work, and play not seen in other areas of the country. You don’t want to miss out on buying when the community is growing. Median appreciation in the Denver Metro area is at 6%. Now is the time to gain optimal appreciation to help you reach your financial goals.

New materials and construction techniques contribute to a reduced likelihood of repairs and replacements. When buying new construction, builders typically offer warranties on various components of the home, providing you with peace of mind and potential cost savings in the long run.

New construction homes are designed with advanced insulation, HVAC systems, and energy-efficient appliances, resulting in lower utility bills and a reduced carbon footprint. Additionally, these homes often come equipped with smart home technology, allowing you to control various aspects of your home remotely. These features not only enhance your quality of life but also contribute to long-term cost savings.

slfjdkfdjfj

The current lending landscape, and builder incentives are other factors that make now an optimal time for investing in a new construction home. Many homebuilders are buying down rates, and offering closing incentives to help people get into a new home.

While interest rates may seem relatively high compared to the historic lows of 2020 and 2021, the rates are a lot less than the 10-12% interest rates of 30 to 40 years ago. In fact, today’s rates are still relatively low from a historical standpoint. Our home builders work with preferred lenders who can help you secure a mortgage at a favorable interest rate now, and help set a strategy to help you refinance in the future.

Many realtors and real estate experts stress the importance of buying now versus waiting for “interest rates to go down.” Why? Because chances are interest rates are likely to go up again over the next few quarters in an effort to stave off inflation. Once things settle, rates will eventually come down and you will be ready to refinance, and have the one thing that every homeowner wants – equity.

Home prices also continue to go up, even though prices have recently improved in the Denver Metro area. The moral of the story is that you can’t time the market. It just doesn’t pay to wait. Get in and gain equity to help you reach your future goals – pay off debt, save, buy a bigger home (when the time is right) – all to help you secure your financial future.

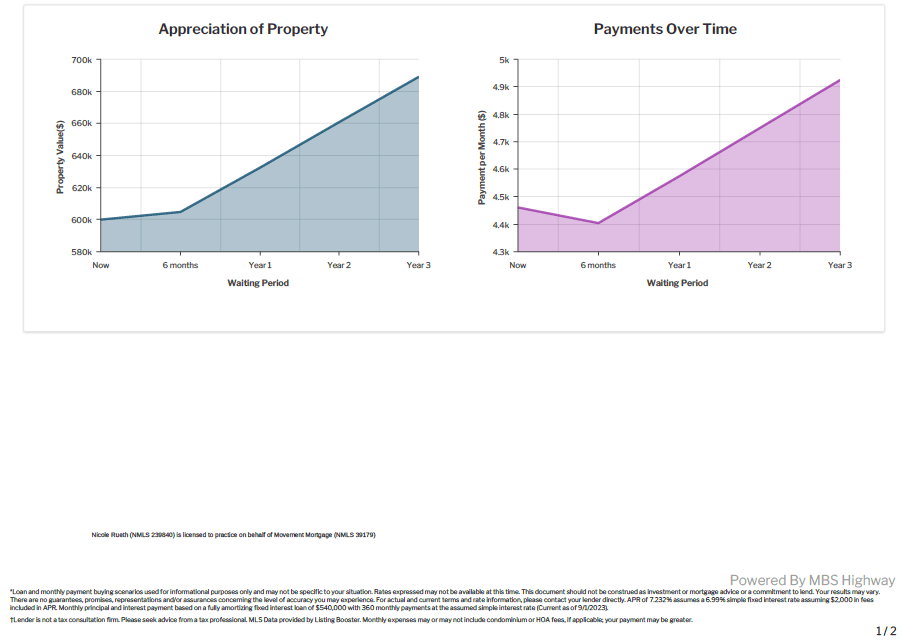

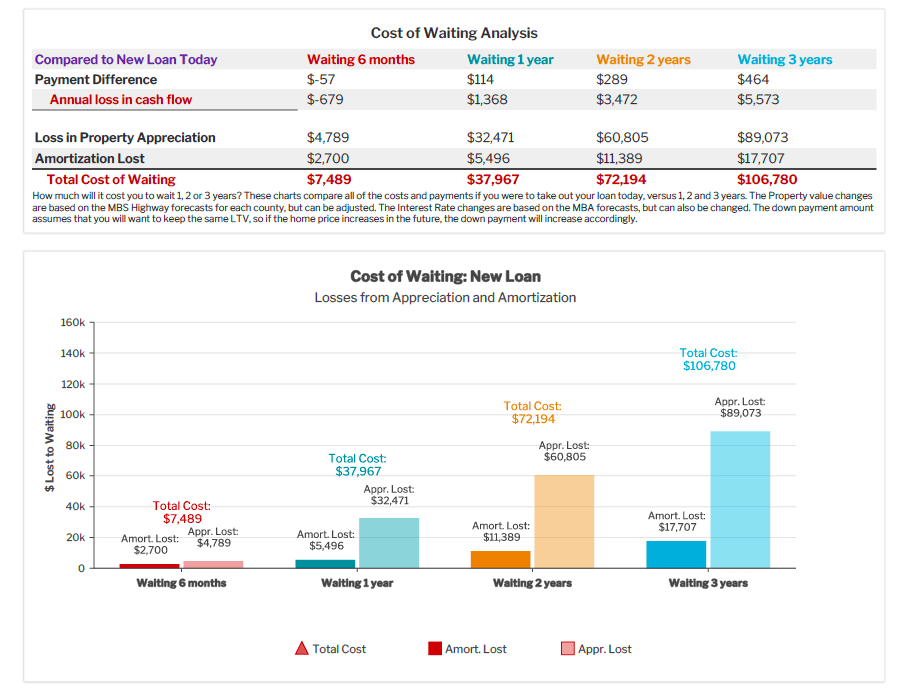

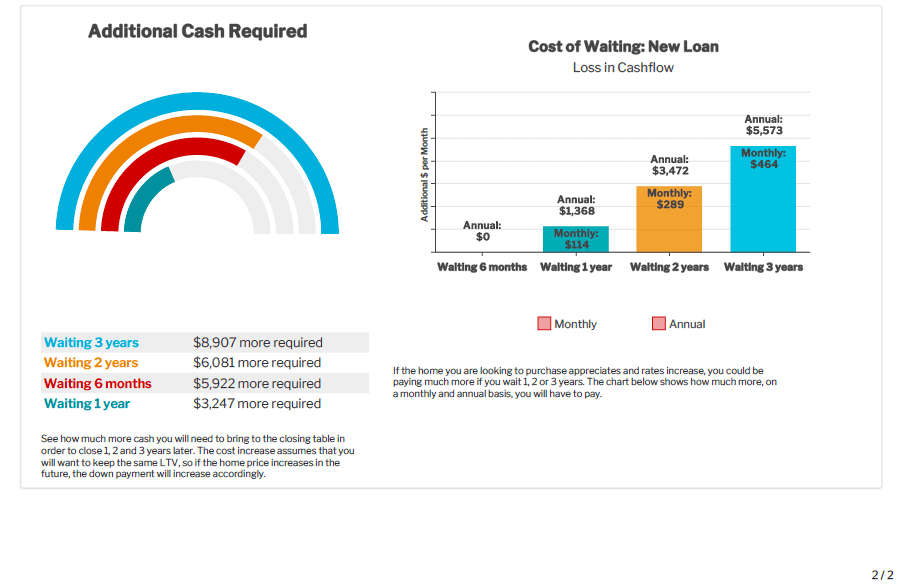

Want to see how far your money could go if you bought now versus three years from now? Check out this analysis by Nicole Rueth, SVP of The Rueth Team with Movement Mortgage. For example: If you were to wait three years to buy a $600,000 home in Adams County (the county where Painted Prairie is located) it would cost you $106,780. This includes annual loss in cash flow, loss of property appreciation, and amortization lost in just 3 years vs. buying now.

Now more than ever, it is a great time to consider buying a home today, versus waiting.

If you are interested in learning more about Painted Prairie’s builder incentives, visit our Inventory page to connect with one of our seven world-class builders. Click on a house for more information, and you will be redirected right to the builder to schedule a tour, get more information on the home, or sign up for an interest list.

Happy house hunting!

Once we heard of Painted Prairie in 2021, we were hooked! We loved the diversity of the community, the open space, and everything else it has to offer. Our house has very rapidly turned into a home. We actually met some of our closest friends at a Painted Prairie event.

Painted Prairie has become a place that feels like home for my family because of the strong sense of community and the diverse and inclusive atmosphere. It’s a place where we can connect with neighbors, support local businesses, and truly feel like we belong. The shared values of unity, diversity, and sustainability in the community align with what our family holds dear. It’s a place where children can thrive, and we can contribute positively to the community.

Being an active community while bringing us together on the different events throughout the year. We have been fortunate to enjoy the farmers markets, the neighborhood BBQ, the pancake breakfast, the family painting class, movies at the park and the Fall Festival! Our son and dog also love all the parks!